Have you ever wondered if you need to have an independent appraisal before pawning an item? The short answer is no. An independent appraisal is not necessary in order to pawn an item; however an independent appraisal can sometimes be useful to both the individual looking to pawn an item as well as the pawn […]

August 22, 2016

August 8, 2016

Traditional Loans vs. Pawn Loans

The recent wave of reality TV shows has created a perception that pawn shops are really great places to buy and sell unique and/or rare items. However, that perception is a bit skewed and has taken the focus off of what pawn stores were originally intended for. That is, to provide loan options to those […]

July 25, 2016

How to Tell if your Gold is Real

In need of quick cash? One of the most common items pawned for quick cash is gold. It can be difficult to distinguish real solid gold pieces from gold plated or fashion jewelry by sight alone, though. So what is the best way to determine if your gold is real and can be pawned for […]

July 11, 2016

5 Luxury Items You Can Pawn for Money

Sometimes you need to get cash quickly for short term use. You may find yourself looking around your house, wishing that you could get money for some of your valuables. You’ll be happy to know that you can, in fact, pawn luxury items. This works much the same way it would if you were to […]

June 27, 2016

What You Need to Know about Firearms Consignment

If you own firearms, you may wonder about selling firearms on consignment. There are many lines of thinking about this, but if you’d like to sell your guns for a fair price, consignment can often help you get the best price for your guns. Before you get started, there are a few things you should […]

June 13, 2016

Can I Fund My Small Business with Pawn Loans?

If you own a small business, from time to time you’ll find you need access to quick cash. There’s not always time to fill out the paperwork or wait to get approval from a bank; things often need to happen quickly in order to take advantage of the opportunities that present themselves for your business. […]

May 23, 2016

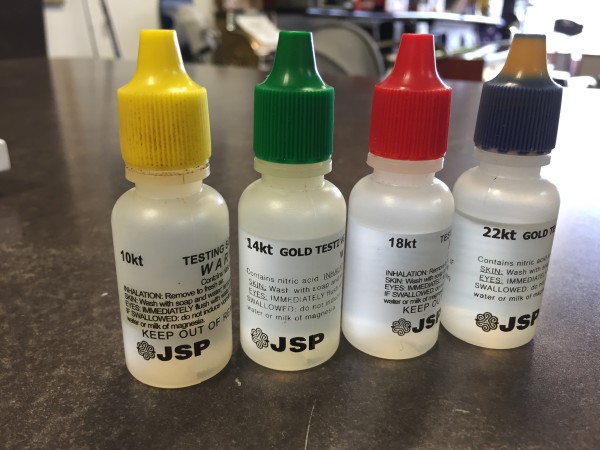

The Differences Between 10, 14, 18, 22 and 24 Karat Gold

It can be quite confusing to purchase items made of gold without fully understanding the differences between karats. Even when speaking to a jeweler or pawnbroker, it’s not always easy to determine what number of karats would be best for your purchase. In fact, if you talk to ten different people, you may well get […]

May 9, 2016

3 Things to Consider When Valuing Gold Items

Many people have gold items lying around the house, unused for whatever reason. It’s not surprising that people often wonder what those items may be worth. In order to understand the value of gold items, experts look at a variety of factors. The main three things that one should consider when pricing items made from […]

April 25, 2016

The Evolution of the Pawn Industry

All too often, when people think of pawn shops, they think of a stereotype they saw in a movie one time. We all tend to associate businesses we don’t know with what we see in the media. Unfortunately, these portrayals are not always accurate. The pawn industry today is a vibrant business community, with many […]

Recent Comments