Quickly and confidently locate the best local pawn shop with our comprehensive guide to Lambert Pawn in Whittier, CA. Eliminate the guesswork and identify this trusted establishment for immediate cash needs, secure loans, or unique purchases. Learn to distinguish Lambert Pawn through ratings, reviews, and essential tips, enhancing your pawn shop experience. Key Considerations Effectively locate Lambert […]

January 7, 2024

November 20, 2023

Leveraging Collateral Loans at Lambert Pawn: A Practical Approach to Overcoming Unexpected Expenses and Building Credit for the Future

Life is unpredictable, and unexpected expenses can arise at any moment. Whether it’s a medical emergency, car repair, or other unforeseen financial challenges, navigating these situations can be daunting. Lambert Pawn offers a practical solution through collateral loans, providing a way to manage immediate financial needs, while also offering an opportunity to build or rebuild […]

July 10, 2023

Lambert Pawn: What Are The Benefits Of Pawning Here?

For those seeking a trustworthy, professional, and convenient avenue for pawning valuable items, look no further than Lambert Pawn. Serving customers for several years, we have firmly established ourselves in the heart of the community, offering a reliable service that meets all your immediate financial needs. Known for our transparency and honesty, Lambert Pawn continues […]

September 7, 2018

Most Popular Items to Pawn

Pawn shops have a lot of stigmas attached to them that aren’t true. One of them that we find fairly comical is that the only items you can pawn are invaluable, rare antiques. Often when people are considering getting quick access to cash via a pawn loan, they think that they need to scrounge through […]

June 25, 2018

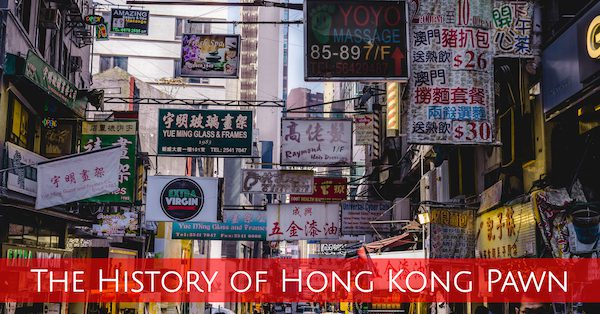

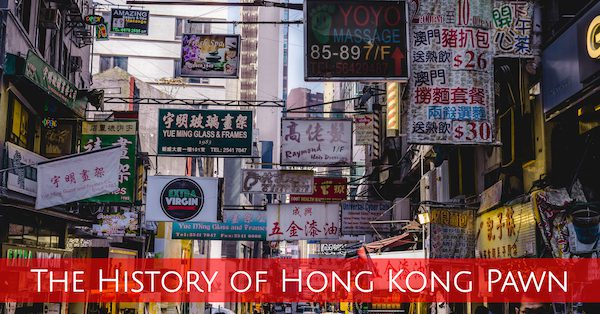

History of Hong Kong Pawn

Pawn shops have a long and robust history throughout the world. One of the longest-running pawn civilizations is that of Hong Kong. Dating back to 3,000 years, Buddhist monks began the first ever recorded pawn and trade operation when they began granting loans to peasants while holding common household goods as collateral. The world took […]

June 4, 2018

Luxury Pawn Shops

Most of us common folks can relate to the expression ‘“cash poor”, but when you think of what being cash poor looks like, you probably don’t envision Rolex watches and Ferraris. However, that is exactly what cash poor looks like in the world of luxury pawning. In a world where individuals have a high number […]

January 22, 2018

What TV Doesn’t Tell You about Pawn Shops

In the last ten years, a tide has shifted in the pawn shop industry. Or rather, in the way the pawn shop industry is viewed. In 2009, a reality show called, “Pawn Stars” debuted on the History Channel. It quickly became a fan favorite and is still on the air today despite the flurry of […]

September 11, 2017

Pawning Vinyl Records

Sometimes old things become cool again, and just like Betty White, beards, and bell-bottoms, vinyl records are back. In fact, for the past 10 years, the sale of vinyl records is up 28%! One argument for the rise in vinyl sales is that the sound quality of a record dominates pretty much any other form […]

June 12, 2017

4 Warning Signs of a Bad Pawn Shop

Contrary to a popular-but-outdated belief, pawn shops are not interested in buying your stolen goods. A pawn shop’s long-term success relies on its repeat customers, which means its reputation can make or break its business. If you’ve read about the benefits of buying or selling through a pawn shop and want to be sure to […]

- 1

- 2

Recent Comments